Expanding to Amazon UK gives you access to over 60 million monthly active users and a slice of Europe’s third-largest e-commerce market, valued at over £120 billion.

However, navigating VAT regulations, local consumer preferences, and logistics can feel overwhelming without a clear plan. This guide breaks it all down step-by-step, providing the exact information you need to confidently launch and succeed in this lucrative marketplace.

Step 1: Evaluate Demand in the UK Market

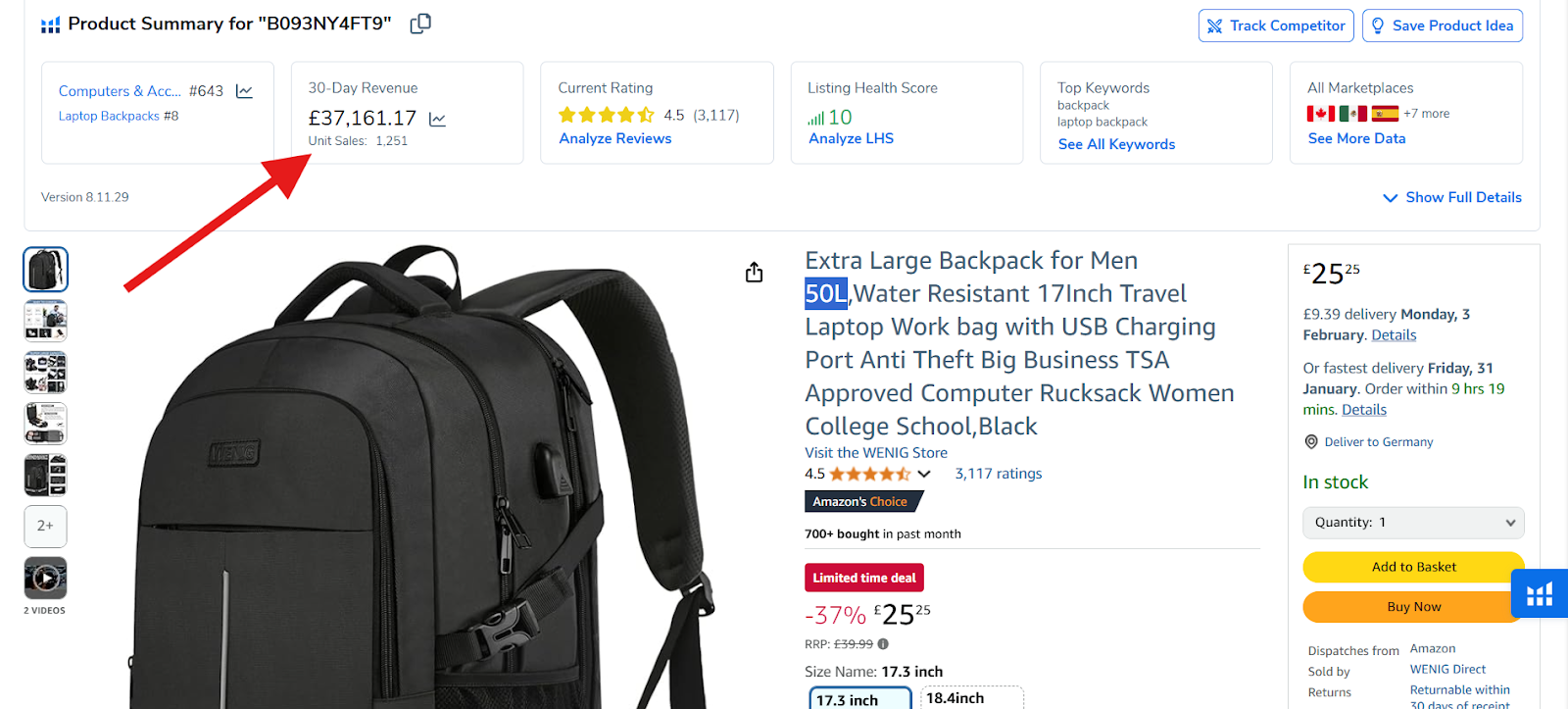

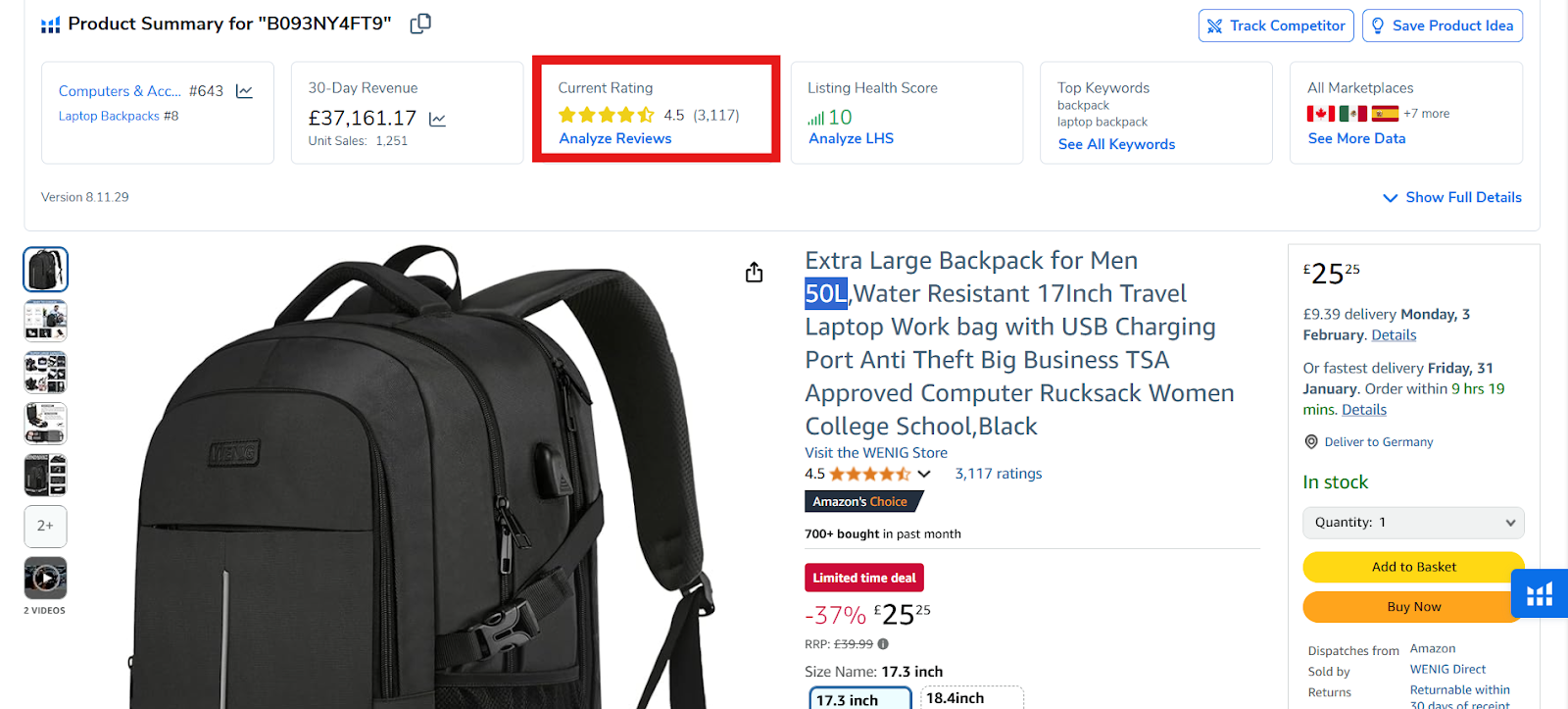

Before expanding to Amazon UK, it’s essential to ensure that your product has strong demand in the marketplace. Tools like Helium 10 X-Ray allow you to analyze competitors’ performance and get detailed sales data to help you make an informed decision.

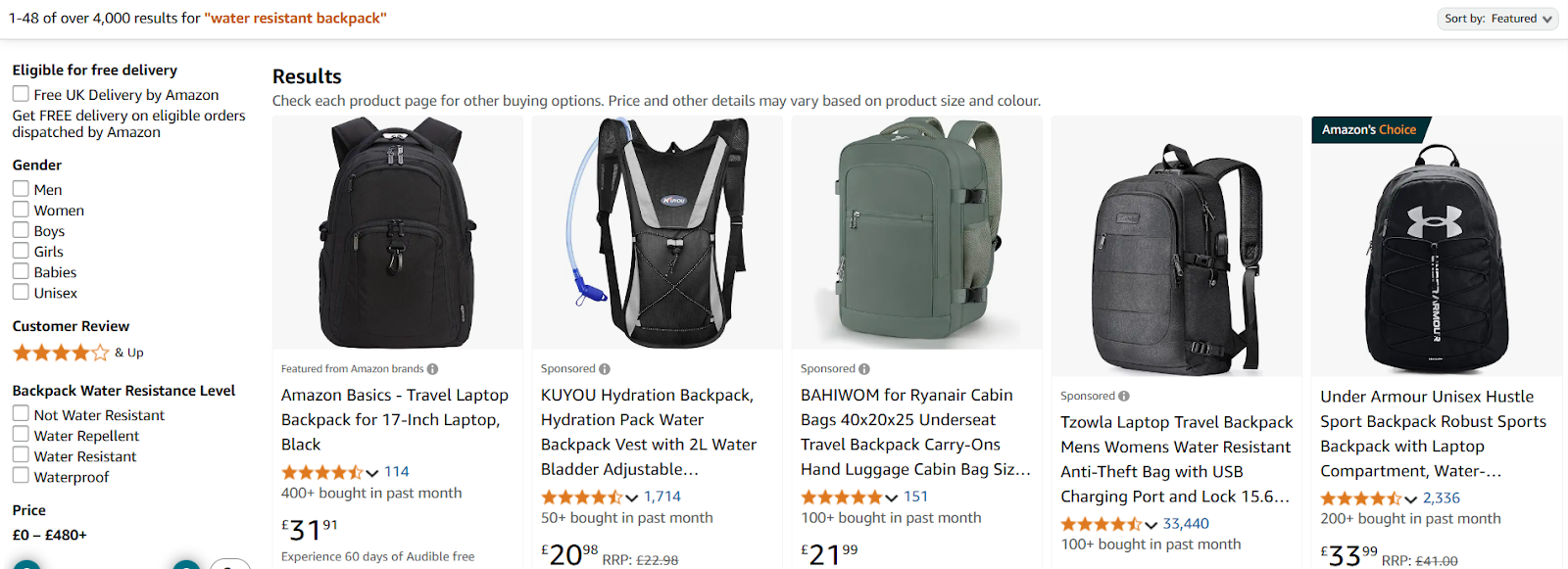

To see if there’s a growth opportunity for your product in the Amazon UK marketplace, go to Amazon.co.uk and enter your product’s main keyword (e.g., “water resistant backpack”) in the search bar. This will show a list of products already selling in your category.

Next, identify 5-10 listings with lots of reviews and high rankings and lower-performing listings that are most similar to yours.

Using the X-Ray Chrome extension, look at how many units each competitor is selling per month.

If competitors in your category are consistently selling between 500–1,000 units per month, this indicates strong demand. However, if most listings are selling fewer than 100 units monthly, it might not be worth pursuing.

Additionally, pay attention to customer reviews on competing products. Reviews can reveal opportunities to stand out by solving common complaints shoppers have.

Evaluating demand with precise data ensures that you’re not entering the Amazon UK marketplace blindly but are setting yourself up for success by selling a product that UK customers are actively searching for and buying.

Step 2: Prepare for UK Compliance

Expanding your Amazon business into the UK market requires adherence to legal and tax obligations specific to the region to ensure smooth operations and avoid potential penalties.

Here’s a breakdown of key obligations that differ from those in the US marketplace:

1. Value Added Tax (VAT) Registration and Non-Resident Importer (NRI) Status

As a US-based seller without a physical presence in the UK, you’re classified as a Non-Established Taxable Person (NETP). To operate legally, you must register for UK VAT if:

- You store goods within the UK.

- Your taxable turnover from UK sales exceeds £85,000 in a 12-month period.

Even if your sales are below this threshold, voluntary VAT registration can enhance your business’s credibility and allow you to reclaim VAT on import-related expenses.

In addition to VAT registration, you’ll need to set up as a Non-Resident Importer (NRI), which allows you to import goods into the UK and ensures you handle VAT and customs duties on imported goods.

To register:

- Apply for VAT registration through HMRC’s online portal.

- Obtain an EORI (Economic Operators Registration and Identification) number through the UK government portal to handle customs declarations.

To simplify this process, many sellers work with tax advisors or customs brokers who specialize in VAT registration and import procedures.

2. Import Duties and Customs Declarations

When importing goods into the UK, you must:

- Submit Accurate Customs Declarations: Clearly state the value and nature of your goods to avoid fines or delays.

- Pay Import Duties: Rates vary based on product type and origin; consult the UK Trade Tariff for specifics.

Using a customs broker can simplify the process, ensuring all documentation is accurate and duties are calculated correctly.

3. Product Compliance Standards

The UK has specific standards that may differ from US regulations:

- Safety Certifications: Certain products, such as electronics, must carry a CE marking (or UKCA marking post-Brexit) to demonstrate compliance with health, safety, and environmental standards.

- Labeling Requirements: Products must have accurate labels, including metric measurements, clear instructions, and appropriate safety warnings.

- Restricted Items: Some products, such as food or cosmetics, are subject to additional regulations. Check that your products comply with all UK laws to avoid penalties or removal from Amazon UK.

Step 3: Set Up Your Amazon UK Seller Account

Expanding to Amazon UK is a seamless process for Amazon US sellers thanks to Amazon’s marketplace network.

Here’s how to set up your Amazon UK Seller Account:

1. Link Your US and UK Seller Accounts

Amazon’s Global Selling Program lets you link your accounts and manage your international sales from one unified dashboard. To link your US account with the UK:

- Go to Seller Central and navigate to the Global Selling section.

- Scroll to the “Amazon Stores Worldwide” section, select “Link Accounts”, and follow the prompts to connect your US and UK marketplaces.

- Once linked, you can switch between your US and UK accounts from one dashboard, making it easier to manage listings, inventory, and orders.

2. Verify Your Information

Even with your US account linked, Amazon UK requires some region-specific verification:

- Bank Account: Add an account that can receive GBP payments. Many sellers use services like Wise Business or Payoneer to reduce currency conversion fees.

- VAT Details: If you’re already registered for VAT (covered in Step 2), enter your VAT number.

- Business Address Verification: Provide proof of your business address, such as utility bills or bank statements.

- Identity Verification: Submit valid identification documents, like a passport or driver’s license, to comply with U.K. regulations.

3. Choose the Right Selling Plan

Amazon UK offers two selling plans:

- Individual Plan: Ideal if you plan to sell fewer than 35 items per month. There’s no monthly subscription fee, but you’ll pay a £0.75 fee per item sold.

- Professional Plan: Best for those aiming to sell more than 35 items monthly. This plan has a £25 monthly subscription fee and provides access to advanced selling tools, including bulk listings and Amazon Advertising.

Since you’re already selling on Amazon, the Professional Plan is typically the better choice for scaling into the UK market.

Step 4: Create Optimized Product Listings for the UK

Expanding to Amazon UK requires tailoring your listings to align with UK customer preferences and marketplace standards. Here’s how to do it:

1. Transfer Listings with BIL

Amazon’s Build International Listings (BIL) tool simplifies the process of transferring your US listings to Amazon UK.

To access BIL, navigate to “Inventory” > “Sell Globally” > “Build International Listings.”

Next, select your US account as the source and your UK account as the target.

Additionally, BIL can account for VAT and currency differences, ensuring your prices are competitive in the UK. For example, if your product sells for $100 in the US, BIL will convert this price to GBP, add VAT (20%), and display the adjusted price on Amazon UK.

2. Localize Your Listings

To resonate with UK shoppers, your listings must reflect local preferences:

- Use British English: Replace terms like “color” with “colour” and “organize” with “organise.”

- Metric Measurements: List dimensions and weights in centimeters, meters, and kilograms instead of inches, feet, and pounds.

3. Conduct UK-Specific Keyword Research

Although your US keywords may perform well, UK shoppers might search differently.

- Use tools like Helium 10 or Jungle Scout to identify UK-specific search terms.

- Pay attention to local phrases or terminology. For instance, “diaper bag” in the US is “nappy bag” in the UK.

Step 5: Plan Your Fulfillment and Shipping

Expanding to Amazon UK also means deciding how to store, pack, and ship your products to customers. Amazon provides multiple fulfillment options, and choosing the right one depends on your business size, goals, and resources.

Here are the available options:

1. Fulfillment by Amazon (FBA)

With FBA, you send your products to Amazon’s UK fulfillment centers, and Amazon handles storage, shipping, returns, and customer service.

This option is ideal for sellers who want a hands-off fulfillment process.

Benefits of FBA:

- Prime Eligibility: Your products are listed as Prime, which boosts visibility and increases conversions.

- Faster Shipping: Amazon’s UK warehouses ensure quick delivery, meeting customer expectations.

- Streamlined Operations: Amazon manages returns and customer service, reducing your workload.

What You Need to Know:

- Shipping Inventory to the UK: Sending your products to a designated Amazon UK fulfillment center is not free. Amazon’s FBA Calculator can help you estimate fees, including storage, fulfillment, and referral costs.

- Customs and VAT: You’ll need to handle customs clearance and pay import VAT when shipping inventory to the UK (as covered in Step 2).

2. Pan-European FBA

If you plan to expand beyond the UK into other European markets, consider Amazon’s Pan-European FBA program. This allows you to store products in multiple Amazon warehouses across Europe.

How It Works:

- You ship your inventory to a UK fulfillment center.

- Amazon distributes your products to other European warehouses based on demand.

Benefits of Pan-European FBA:

- Wider Reach: Your products become available in multiple European marketplaces (e.g., Germany, France, Italy).

- Cost Savings: Local fulfillment centers reduce international shipping costs for customers.

What You Need to Know:

- You must register for VAT in all countries where your inventory is stored.

- Pan-European FBA works best for sellers with established sales across Europe.

3. Fulfillment by Merchant (FBM)

With FBM, you store, pack, and ship products directly to customers. This option gives you complete control over the fulfillment process but requires more effort.

Benefits of FBM:

- Control Over Shipping: You can customize packaging and shipping methods.

- Works for Oversized/Slow-moving Items: If your product is bulky or doesn’t sell quickly, storing it yourself can reduce long-term FBA storage fees.

- Better for Low-Margin Products with High Selling Prices: If your product already has low margins, avoiding FBA fees might slightly improve profitability—but only if your logistics costs are well-optimized.

What You Need to Know:

- You’re responsible for customs clearance and international shipping. Partnering with a reliable shipping carrier experienced in UK logistics is essential.

- FBM works best for sellers who have robust logistics systems or handle unique/custom products.

| Feature | FBA | Pan-European FBA | FBM |

| Prime Eligibility | Yes | Yes | No |

| Shipping to customer | Amazon | Amazon | Seller |

| Upfront Costs | Medium | High (multi-country VAT) | Low |

| Scalability | High | Very High | Moderate |

| Control | Limited | Limited | Full |

Conclusion

Remember, success in the UK requires understanding your audience, staying compliant with local regulations, and leveraging tools to streamline operations.

With a clear strategy in place, you can tap into the vast potential of the UK marketplace and grow your brand globally.